Vision Insurance Plans

Keeping up with routine eye care is important for your overall health, as many eye diseases are common and can go unnoticed.* Detecting these diseases early with annual eye examinations can help with treatment to prevent vision loss or blindness.

Why Choose a Vision Plan from Medical Mutual?

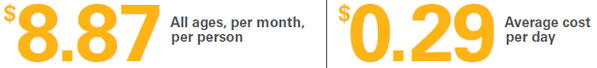

Medical Mutual’s vision insurance plan is designed to help reduce the cost of routine eye care—ultimately saving you money and keeping you at your healthiest. Our vision plan provides access to more than 4,000 optometrists and ophthalmologists who are part of the EyeMed network. Some of our vision plan’s annual benefits include coverage for an eye examination and a pair of eyeglasses or contact lenses.

The EyeMed Network

Look for your preferred optometrist, as well as other in-network providers in your area or nationwide, using our online search tool.

Medical Mutual Vision Plan FAQs

Can I purchase a Medical Mutual vision plan without having medical coverage?

Yes, our vision plan can be purchased as standalone coverage. You may want to consider purchasing medical insurance to enhance your overall coverage.

Can my vision plan cover my family as well?

Yes, your vision plan can cover family members. In addition, dependents age 19 or under will have $0 copays for annual eye examinations as well as a frame and lenses. Dependents can stay on your vision plan up until their 26th birthday.

Do I have to choose an eye doctor in the network?

No, but your costs will be lower if you choose a provider who is in network. Our network includes thousands of eye care providers throughout Ohio. Before enrolling, you can search the EyeMed network to see doctors that are included.

Ready to Shop?

Use our online enrollment tool to get an instant quote. You can also call us at 1-844-583-3072 or call your licensed insurance agent.

*Source: CDC. Keep an Eye on Your Vision Health

Disclaimer: This information only provides a partial listing of benefits. This is not a contract for insurance. No person other than an officer of Medical Mutual may agree, orally or in writing, to change the benefits listed here. The contract or certificate will contain the complete listing of covered services.

See if you qualify for financial assistance.

You may qualify to receive a subsidy, which is a tax credit that lowers your monthly premium. Check to see if you're eligible for these savings!